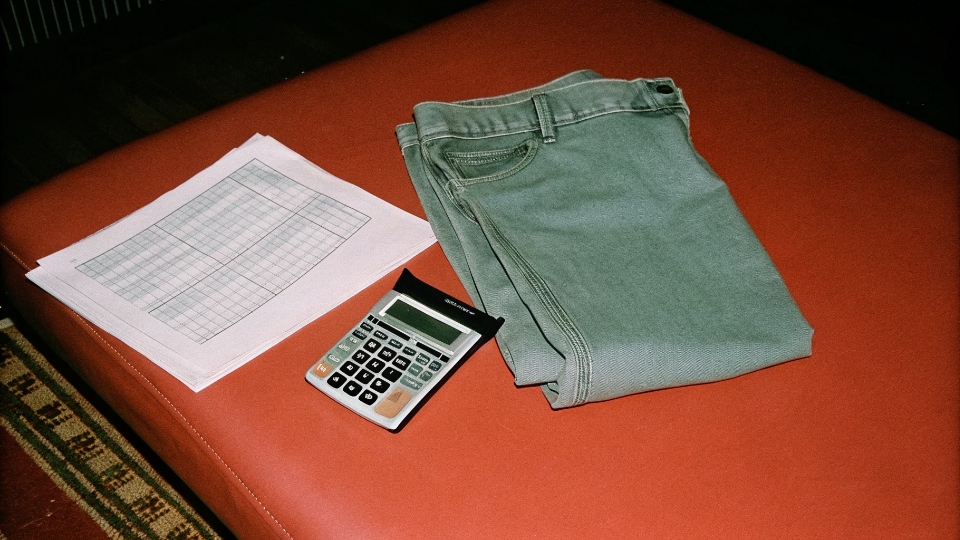

Your factory quote looks good, but you fear hidden costs. Unexpected fees for shipping, packaging, and taxes can erase your profits, making your entire import risky and unpredictable.

To calculate your total landed cost1, you must add the factory price to all other expenses. These include packaging, freight, insurance, customs duties, and local taxes. Get detailed written quotes for each component.

I once worked with a designer who was thrilled with our $10 per-unit price. But they only budgeted for the factory cost.

They were shocked when the final price was closer to $16 after shipping and duties. The factory price is just the beginning.

The real number is the "landed cost"—the price to get the jeans to your warehouse door. Let's start with the small costs that often get missed but add up fast.

Which Packaging and Labeling Fees Should I Include?

Your jeans look amazing, but they arrive in cheap poly bags with generic labels. This damages your brand perception and can cause compliance issues with retailers, hurting your reputation.

Include detailed costs for both standard packaging (export cartons, poly bags) and all custom items (branded hangtags, woven labels). Always get a specific per-unit price to avoid vague "included" promises from your supplier.

Many designers think of packaging last, but it's a critical part of your product's presentation and protection.

You must account for two types of costs. First is the basic packaging. Ask your supplier for the per-unit cost2 of a strong, export-grade shipping carton3 designed for international transit.

Also, get the price for the individual poly bags that protect each pair of jeans from moisture and dirt. The second part is your custom branding.

This includes your woven neck labels, care instruction labels, and branded hangtags.

You need to ask about any one-time setup fees4 for creating these items, as well as the per-unit cost to produce them and attach them to the garments.

For example, a custom recycled paper hangtag will cost more than a standard one. Getting a detailed list of these costs prevents them from becoming a surprise on your final invoice.

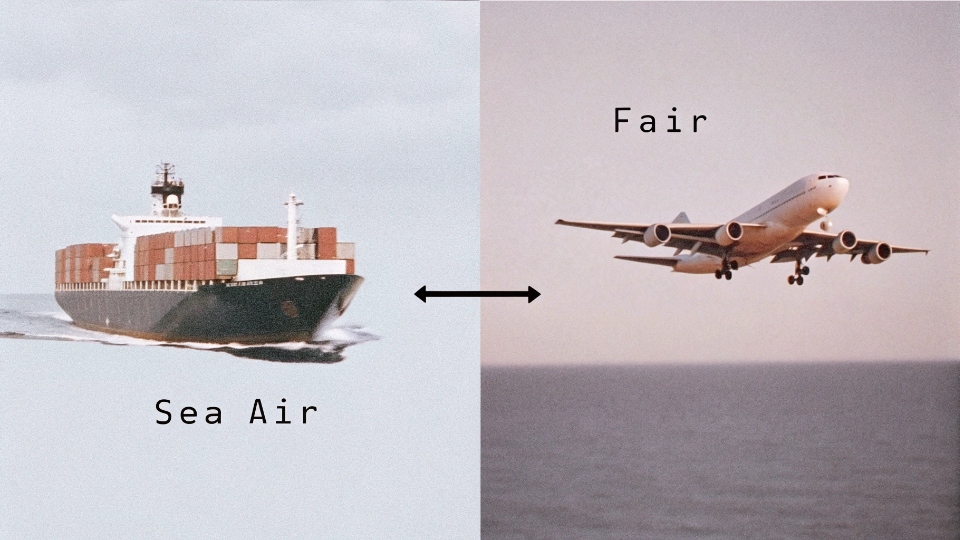

How Do You Estimate Freight and Door-to-door Logistics Charges?

You have your production cost, but shipping feels like a black box. A bad freight estimate can turn a profitable order into a financial disaster overnight, wiping out your margins completely.

Ask for quotes on both sea and air freight based on your total order volume. Ensure the quote is for "door-to-door" service and explicitly lists all extra fees like customs clearance and last-mile delivery.

Freight is often the biggest variable in your landed cost, so you need to control it. You must first provide your order quantity to your supplier.

Let's say it's 3,000 pairs. Ask them to estimate the total volume in cubic meters (CBM) and the total weight. With this information, they can give you quotes for both sea and air freight.

Sea freight is much cheaper but slower, while air freight is fast but expensive. Crucially, you need to ask for a "door-to-door" quote, not just "port-to-port."

A door-to-door quote should include all the hidden fees that come later: terminal handling charges at the port, customs clearance fees5, and the final truck delivery to your warehouse.

Also, ask if the quote includes potential unknowns like fuel surcharges or peak season charges. This detailed quote is the only way to establish a realistic transportation budget.

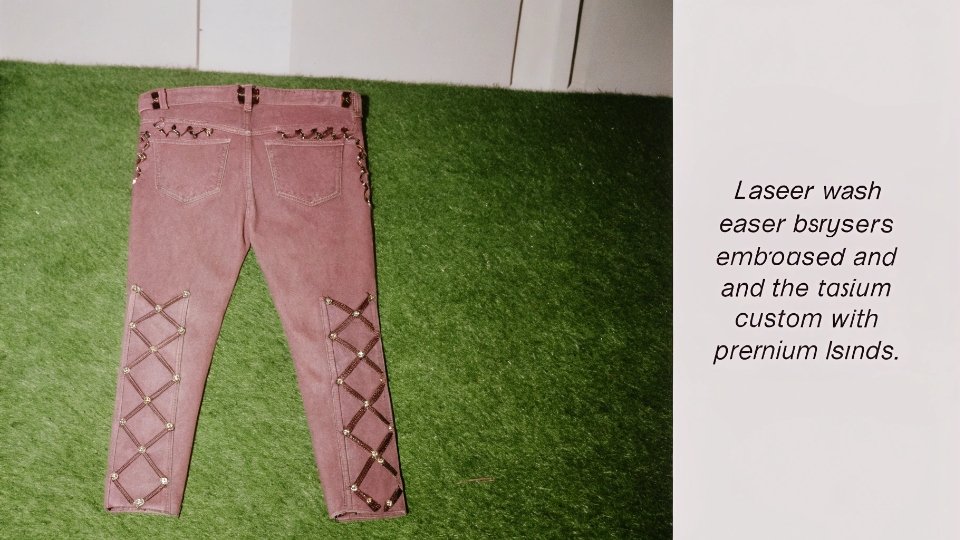

Are There Surcharges for Specialty Washes or Hardware?

You designed jeans with a unique acid wash and custom buttons. The initial quote was great, but the final invoice has huge surcharges you never approved, leaving you feeling cheated.

Yes, almost always. Complex washes and premium hardware like YKK zippers cost more. You must get a detailed, per-unit surcharge for each special feature and approve it in writing before production begins.

A standard pair of jeans has a standard price. Your custom design features are what make them unique, but they also add cost.

These are called surcharges. For example, a complex wash like a two-tone bleach or a heavy hand-sanding treatment takes more man-hours and special chemicals.

You should ask for the exact per-unit surcharge for the specific wash you want. Similarly, hardware makes a big difference.

If you upgrade from a standard factory zipper to a branded YKK zipper, there will be a surcharge. If you want custom-embossed buttons with your logo, there will likely be a tooling fee for the mold plus a higher per-unit price.

Always ask for a clear breakdown: "How much extra for this specific wash? How much extra for these custom buttons?" Get these numbers on your official price quote before you agree to move forward.

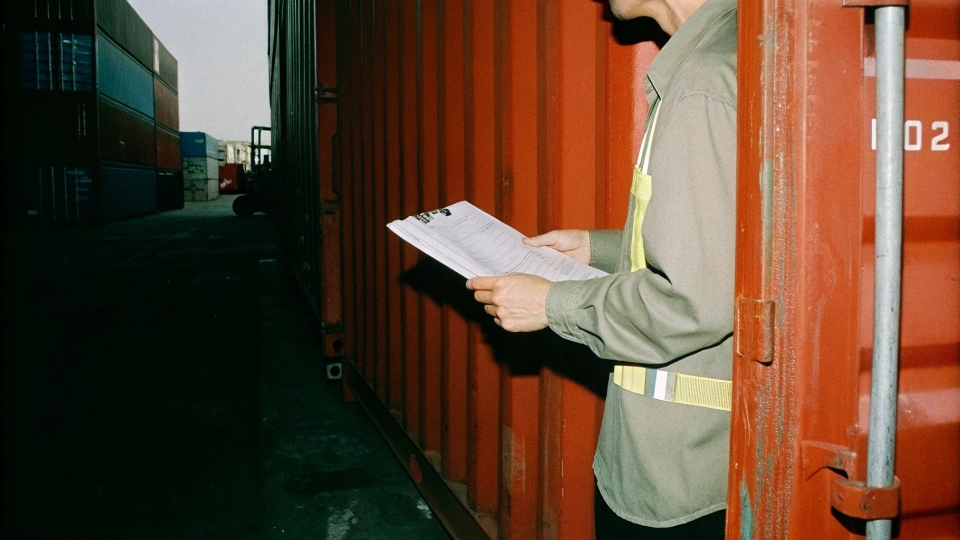

How Do I Factor in Customs Duties and Local Taxes?

Your jeans have arrived at the port, but they're stuck. Customs is holding them because the duties are unpaid, and the amount is much higher than you ever expected in your budget.

First, get the correct Harmonized System (HS) code6 for your jeans from your supplier. Use that code to look up the duty rate on your government's customs website. Remember to calculate duty on the CIF value7.

This is the final and most official cost. It is non-negotiable. First, you need the Harmonized System (HS) code for your product.

For men’s cotton denim jeans, this is often 6203.42. Ask your factory to confirm this code on their commercial invoice.

Then, visit your country's official customs website (like the US CBP or EU TARIC sites) and find the duty rate for that code. Let's say it's 16%. This duty is not calculated on the factory price alone. It's calculated on the "CIF Value."

Understanding CIF Value

| Component | Description | Example |

|---|---|---|

| Cost | The price of the jeans per unit. | $10.00 |

| Insurance | The cost to insure the shipment. | $0.20 |

| Freight | The cost of shipping to your port. | $1.50 |

| Total CIF | The value used to calculate duty. | $11.70 |

The duty would be 16% of $11.70. On top of that, you may have local taxes like VAT or GST. You must consult a customs broker or your government's website to get these numbers right.

Conclusion

Calculating your landed cost is not hard when you know the components. Add up your factory price, packaging, freight, surcharges, and duties to find your true cost and ensure profitability.

-

Understanding total landed cost helps you avoid unexpected expenses and ensures accurate budgeting for your imports. ↩

-

Calculating per-unit costs accurately is vital for pricing strategies and maintaining profitability. ↩

-

Understanding the importance of export-grade shipping cartons can protect your products during transit. ↩

-

Understanding one-time setup fees can help you budget for initial production costs effectively. ↩

-

Knowing about customs clearance fees helps you prepare for additional costs and avoid shipment delays. ↩

-

Learning about HS codes can help you determine duty rates and ensure compliance with customs regulations. ↩

-

Understanding CIF value is key to calculating customs duties accurately and managing import costs. ↩